Bone Grafts and Substitutes Market Size Worth USD 5.68 Billion by 2034 Fueled by Orthopedic Demand and Regenerative Innovations

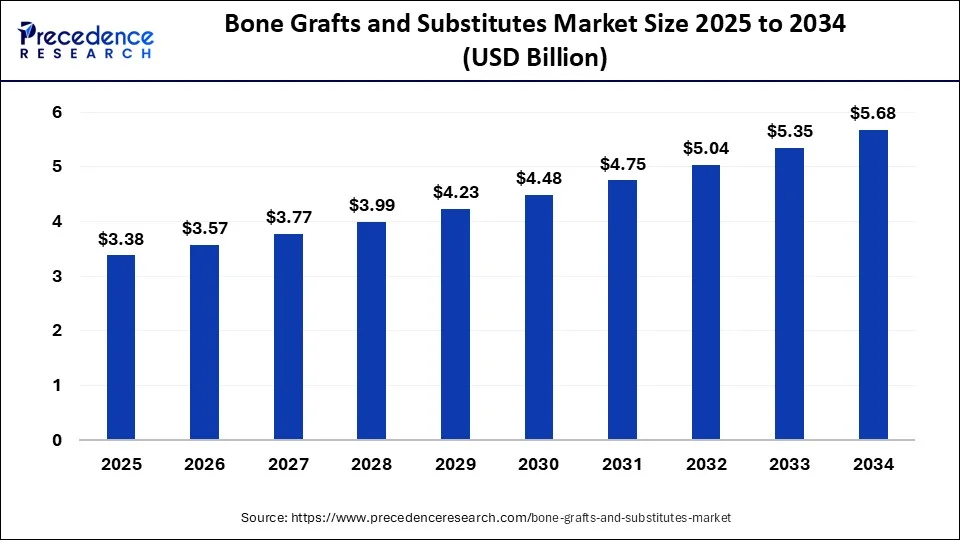

According to Precedence Research, the global bone grafts and substitutes market size will grow from USD 3.38 billion in 2025 to nearly USD 5.68 billion by 2034, with an expected CAGR of 5.94% from 2025 to 2034. Growth is driven by rising orthopedic disorders, trauma cases, and demand for advanced bone healing solutions, with innovations in biomaterials, 3D printing, and bioresorbable grafts creating opportunities across orthopedic, dental, and spinal applications.

Ottawa, Sept. 19, 2025 (GLOBE NEWSWIRE) -- The global bone grafts and substitutes market is expected to be worth around USD 5.68 billion by 2034, increasing from USD 3.57 billion in 2026, growing at a CAGR of 5.94% from 2025 to 2034. This market is growing due to the rising prevalence of orthopedic disorders, increasing trauma and accident cases, and the growing demand for advanced bone regeneration solutions. The growing burden of orthopedic disorders and breakthrough innovations in regenerative medicine are pushing the bone grafts and substitutes market into a new growth era.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2006

Bone Grafts and Substitutes Market Key Takeaways:

- In terms of revenue, the global bone grafts and substitutes market was valued at USD 3,200 million in 2024.

- It is expected to exceed more than USD 5,680 million by 2034.

- North America accounted for the largest market share of 47.62% in 2024.

- Asia Pacific is projected to grow at the fastest CAGR of 6.6% between 2025 and 2034.

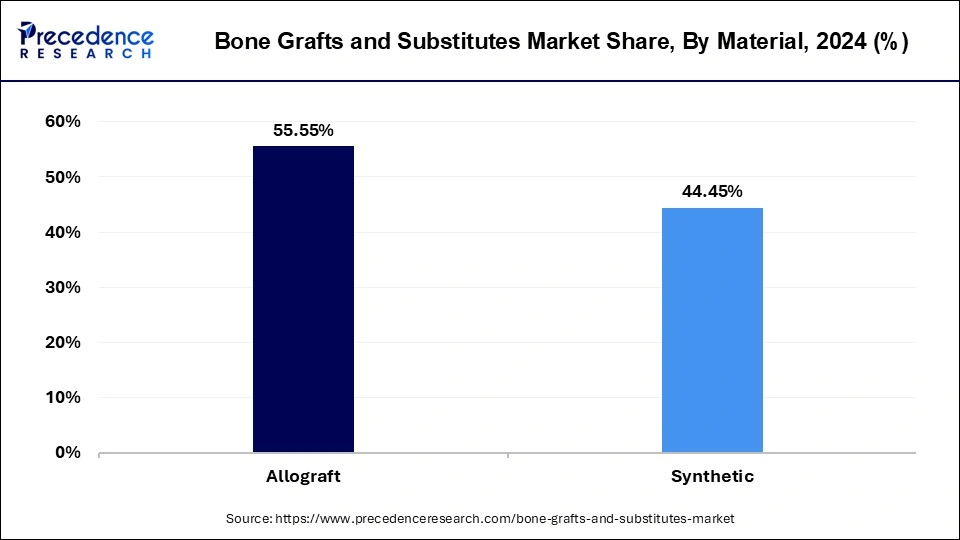

- By material, the allograft material segment held the maximum market share of 55.55% in 2024.

- By end user, the hospital segment generated the major market share of 62.75% in 2024.

- By end-user, the specialty clinics segment is anticipated to exhibit considerable growth over the forecast period.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2006

Bone Grafts and Substitutes Market Overview

The bone grafts and substitutes market is experiencing steady growth, driven by an increase in trauma injuries, bone-related disorders, and orthopedic surgeries performed globally. The market offers a variety of synthetic alternatives, including ceramics, polymers, and growth factor-based products that promote bone healing and regeneration in addition to autografts and allografts. The market potential is being further expanded by developments in biomaterials, minimally invasive surgical methods, and the increasing use of bioresorbable and 3D printed grafts.

Bone grafts and substitutes are also a result of the aging of the world's population, increased need for osteoporosis treatments, and spinal fusion procedures. All of these elements are working together to position the market for long-term growth in both established and developing healthcare systems.

- In May 2025, Xtant Medical announced the launch of Osteofactor Pro, a next generation bone graft substitute designed to support bone healing in spinal and orthopedic procedures. (Source: https://investor.xtantmedical.com)

Bone Grafts and Substitutes Market Major Sustainability Trends

-

Shift Toward Biodegradable and Bioresorbable Materials

Manufacturers are increasingly developing grafts made from biodegradable ceramics, polymers, and bioresorbable composites that naturally dissolve in the body over time, reducing the need for secondary surgeries and minimizing medical waste.

-

Use of Natural and Renewable Sources

There is a growing focus on graft substitutes derived from natural biomaterials such as collagen, calcium phosphate, and plant-based polymers, which are more sustainable than purely synthetic options and reduce environmental impact in production.

-

Advances in 3D Printing and Additive Manufacturing

3D-printed bone grafts allow for customized implants with minimal material wastage compared to conventional manufacturing. This trend not only enhances patient outcomes but also supports eco-friendly production practices.

-

Reduction in Animal-Derived Products

To address ethical and sustainability concerns, companies are moving toward alternatives that limit or eliminate the use of animal-sourced materials, replacing them with synthetic or recombinant substitutes.

-

Energy-Efficient Manufacturing and Green Processes

Many players are adopting cleaner, energy-efficient production methods, including closed-loop systems and recycling of byproducts, to reduce their carbon footprint during the manufacturing of bone graft substitutes.

Bone Grafts and Substitutes Market Trends

-

Rising Demand for Synthetic and Bioactive Substitutes: Synthetic options such as bioactive ceramics, polymers, and composite grafts are gaining traction over traditional autografts and allografts, as they reduce risks of infection, disease transmission, and donor-site morbidity.

-

Growth of Minimally Invasive and Regenerative Procedures: Surgeons are increasingly adopting minimally invasive techniques combined with bone graft substitutes, which reduce hospital stays, speed up recovery, and enhance patient comfort, fueling market adoption.

- Increased Use in Dental and Spinal Applications: The demand for bone grafts is expanding beyond trauma and orthopedic surgeries, with significant uptake in dental implants, oral reconstruction, and spinal fusion procedures due to the rising aging population and lifestyle diseases.

- Integration of Growth Factors and Stem Cells: Next-generation graft substitutes are being enhanced with biologics such as bone morphogenetic proteins (BMPs) and stem cells, enabling faster bone regeneration and more reliable healing.

➤ Get the Full Report @https://www.precedenceresearch.com/bone-grafts-and-substitutes-market

Bone Grafts and Substitutes Market Opportunity

Rising Demand in Emerging Economies

Strong opportunities are being created for both local and international players by the rapid urbanization, expanding medical tourism, and better healthcare infrastructure. The need for affordable bone graft alternatives is increasing in these areas due to an increase in orthopedic procedures and trauma cases.

Further motivating patients to choose cutting-edge treatments are advantageous government regulations and expanded insurance coverage. This makes it possible for producers to introduce reasonably priced products that are suited to these markets.

The shift toward bioresorbable materials and 3D-printed solutions marks a turning point in orthopedic care,” said Deepa Pandey, Principal Consultant at Precedence Research. “Hospitals and specialty clinics are prioritizing safer, faster-healing alternatives over traditional grafts, driving strong market momentum.

Bone Grafts and Substitutes Market Challenges & Limitations of the Market:

Risk of Immune Reactions and Disease Transmission

Synthetic grafts reduce risks, but allografts still have the potential to cause immunological rejection and disease transmission. Using donor-based grafts is frequently discouraged by these safety concerns for both patients and clinicians. Supply is also slowed down by stringent laws and intricate sterilization procedures. Their acceptance in certain cultures is further limited by ethical issues surrounding the use of cadaveric tissue. Businesses are constantly developing improved processing and sterilization techniques, but adoption is still hesitant.

Bone Grafts and Substitutes Market Report Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 3.20 Billion |

| Market Size in 2025 | USD 3.38 Billion |

| Market Size in 2031 | USD 4.75 Billion |

| Market Size by 2034 | USD 5.68 Billion |

| Growth Rate 2025 to 2034 | CAGR of 6.80% |

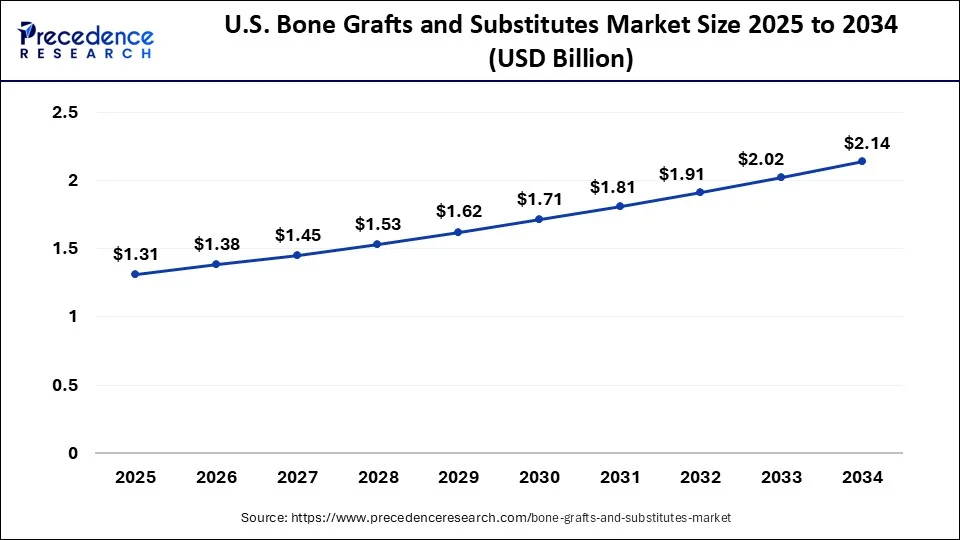

| U.S. Market Size in 2025 | USD 1.31 Billion |

| U.S. Market Size by 2034 | USD 2.14 Billion |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, End User, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players | Smith & Nephew plc, SeaSpine, AlloSource, Bioventus, Medtronic PLC, DePuy Synthes Companies (Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, MTF Biologics, Orthofix Holdings, Inc., and Others |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Case Study: Adoption of Synthetic Bone Grafts in Spinal Fusion Surgery

Background:

A 62-year-old male patient in the U.S. with severe lumbar spinal stenosis and degenerative disc disease required spinal fusion surgery. Traditionally, an autograft (bone harvested from the patient’s own pelvis) would be used, but the patient had comorbidities including diabetes and hypertension, which increased the risk of surgical complications and donor-site morbidity.

Challenge:

Surgeons faced two main challenges:

- Reducing surgical trauma and postoperative recovery time.

- Avoiding complications linked with autograft harvesting, such as infection, prolonged pain, and higher hospitalization costs.

Solution:

The surgical team opted for a synthetic bioactive ceramic-based bone graft substitute enhanced with bone morphogenetic proteins (BMPs). This substitute mimicked natural bone properties, supported osteoconduction, and triggered osteoinduction without requiring additional donor bone harvesting.

Outcome:

- Faster Recovery: The patient was mobilized within 48 hours and discharged within a week, compared to the typical 10–14 days for traditional grafts.

- Reduced Complications: No secondary surgical site complications occurred, eliminating donor-site morbidity.

- Successful Fusion: At the 6-month follow-up, imaging confirmed solid bone fusion with reduced pain scores and improved mobility.

- Cost Efficiency: While the synthetic graft increased upfront material cost, reduced hospitalization days and avoidance of additional surgery lowered overall treatment costs.

Implications for the Market:

This case highlights why hospitals and surgeons are increasingly adopting synthetic and bioactive bone graft substitutes over conventional autografts. The combination of better patient outcomes, faster recovery, and reduced complications is driving market demand. Furthermore, regulatory approvals for advanced biomaterials and FDA-cleared products like 3D-printed synthetic grafts reinforce the shift.

This real-world example demonstrates the clinical and economic value of bone graft substitutes, validating the market trends outlined—particularly the growth of synthetic biomaterials and their adoption in orthopedic and spinal applications.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Bone Grafts and Substitutes Market Regional Analysis

What is the U.S. Bone Grafts and Substitutes Market Size?

The U.S. bone grafts and substitutes market size is valued at USD 1.31 billion in 2024 and is anticipated to reach around USD 2.14 billion by 2034, growing at a CAGR of 5.62% from 2025 to 2034.

North America dominated the global market, supported by a sizable patient base with orthopedic and spinal conditions, a sophisticated healthcare infrastructure, and widespread use of cutting-edge biomaterials. Additional factors supporting the region's leadership included the strong presence of important market players, advantageous reimbursement practices, and growing demand for minimally invasive surgical solutions. The prevalence of trauma cases and the increasing use of bone grafts in spinal fusion and dental procedures were additional factors in North America's dominance.

The U.S. bone grafts and substitutes market remains dominant due to its advanced healthcare, because it has a robust medical device industry, a sophisticated healthcare infrastructure, and a well-established regulatory environment that encourages innovation. Constant demand is being driven by high rates of orthopedic conditions like arthritis, spinal disorders, and fractures from trauma. Favorable reimbursement guidelines, the quick uptake of minimally invasive procedures, and ongoing R&D expenditures on synthetic and bioactive materials further contribute to the U.S. being an important source of revenue.

- In January 2025, Ventris Medical received FDA 510 (k) clearance for backpack Bone Graft Containment System for orthopedic and spinal fusion procedures. ( Source: https://www.biospace.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, driven by growing urbanization, rising healthcare spending, and growing awareness of cutting-edge orthopedic solutions. The region's demand is being driven by the aging population, increased rates of osteoporosis, and fractures from accidents alone. Adoption of synthetic and bioresorbable alternatives is also being accelerated by the growth of medical tourism and the accessibility of reasonably priced surgical procedures.

India's bone grafts and substitutes market is experiencing rapid growth, bolstered by an increase in accident and trauma cases, a growing geriatric population at risk for bone-related disorders, and rising healthcare investments. Adoption is increasing due to more accessible advanced orthopedic solutions, growing medical tourism, and more reasonably priced treatment options. The government's emphasis on improving healthcare accessibility and growing awareness of synthetic and bioresorbable grafts are driving the market's growth in India.

- In February 2025, SCTIMST launch two drug eluting bone graft products, CASPRO and BONYX, developed in its Biomedical Technology Wing and commercialized via Onyx Medicals. ( Source: https://medicaldialogues.in)

Bone Grafts and Substitutes Market Segmentation

Bone Grafts and Substitutes Market Size by Material 2022 to 2024 (USD Million)

| Material | 2022 | 2023 | 2024 |

| Allograft | 1,607.1 | 1,690.5 | 1,799.4 |

| Synthetic | 1,274.2 | 1,346.4 | 1,423.7 |

The allograft segment held a dominant presence in the market in 2024 due to its widespread clinical acceptance, natural bone composition, and strong ability to promote osteoconduction and osteoinduction. Surgeons continue to prefer allografts as they eliminate the need for a second surgery for graft harvesting, reducing patient morbidity. Well-established bone banks and consistent clinical results have further strengthened the segment’s dominance in recent years.

The synthetic segment is growing rapidly in the bone grafts and substitutes market, driven by the growing popularity of biomaterials such as bioactive composites, polymers, and ceramics. As safer substitutes for donor tissues, synthetic grafts lower the risks of immunological rejection and disease transmission. Constant advancements like 3D-printed customized grafts and bioresorbable scaffolds are accelerating the quick uptake of synthetics in a range of orthopedic and dental applications.

- In October 2023, Dimension Inx announced first surgical cases using CMFlex the first FDA cleared 3D printed regenerative synthetic bone graft for oral & maxillofacial applications. ( Source: https://www.prnewswire.com)

End User Analysis

Hospitals accounted for the largest share of the market as they are the primary centers for trauma care, orthopedic surgeries, and complex spinal fusion procedures. Availability of advanced surgical equipment, skilled healthcare professionals, and comprehensive post-operative care facilities makes hospitals the preferred choice for bone graft implantation. High patient inflow for accident and sports injury treatments further supports hospital dominance.

- In September 2025, SurGenTech received expanded FDA clearance for OsteoFlo HydroFiber, enabling use in trauma, tumors, cysts and other hospital level surgical applications beyond spinal fusion.( Source: https://xtalks.com)

The specialty clinics segment is growing rapidly because people are increasingly choosing targeted, minimally invasive, and affordable treatments. These clinics, which offer elective procedures like dental grafting and minor orthopedic interventions, are becoming increasingly outfitted with cutting-edge diagnostic and surgical technologies. They are becoming a more popular choice for patients due to their capacity to offer individualized care, a faster recovery, and shorter wait times.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

For medical device companies, investors, and healthcare providers, these insights highlight opportunities in synthetic biologics, regenerative implants, and cost-effective solutions for emerging economies.

Bone Grafts and Substitutes Market Top Companies

- Smith & Nephew plc (U.K.)

- SeaSpine (U.S.)

- AlloSource (U.S.)

- Bioventus (U.S.)

- Medtronic PLC (Ireland)

- DePuy Synthes Companies (Johnson & Johnson Services, Inc.) (U.S.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- MTF Biologics (U.S.)

- Orthofix Holdings, Inc. (U.S.)

Industry leaders like Medtronic and Stryker are focusing on bioactive materials, while smaller innovators such as Cerapedics are driving peptide-enhanced grafts. Mergers, FDA clearances, and regional partnerships remain key strategies shaping competition.

Recent Developments:

- In March 2025, Elute FDA cleared BonVie+, a synthetic resorbable bone void filler designed for controlled resorption and replacement by new bone.( Source: https://www.medicaldesigndevelopment.com)

- In June 2025, Cerapedics Inc. received U.S. FDA premarket approval for PearlMatrix P-15 Peptide Enhanced Bone Graft, designed to accelerate fusion speed in single-level TLIF spinal surgeries. (Source: https://www.cerapedics.com)

Bone Grafts and Substitutes Market Segments Covered in the Report

By Material

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

By End User

- Hospital

- Specialty Clinics

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2006

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Biosurgery Market: Explore how advanced surgical solutions are driving faster healing and reduced complications in critical procedures

➡️ Bone Metabolism Tests Market: Learn how diagnostic innovations are improving the early detection of bone health disorders

➡️ Bone Growth Stimulators Market: See how non-invasive devices are accelerating bone healing and recovery outcomes

➡️ Bone & Joint Health Supplements Market: Understand the rising demand for nutritional support in maintaining mobility and strength

➡️ Platelet-derived Growth Factors Market: Discover how regenerative therapies are revolutionizing wound care and tissue repair

➡️ Autologous Cell Therapy Market: Track how patient-derived treatments are shaping the future of personalized regenerative medicine

➡️ Medical Ceramics Market: Analyze the expanding role of ceramics in implants, prosthetics, and advanced medical devices

➡️ Cochlear Implant Market: Gain insights into how innovative implants are restoring hearing and transforming quality of life

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.